The End of Risklessness

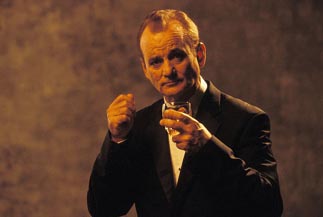

A month and a half ago, George W. Bush used a colorful metaphor to assess the financial crisis.

"There is no question about it. Wall Street got drunk," the president said.

"The question is, How long will it (take to) sober up and not try to do all these fancy financial instruments?"

Why is our current credit crunch worse than all previous ones except the Great Depression? I think I have to agree with the president on this one - "fancy financial instruments" are the reason.

I think the instruments Bush was talking about are the various and sundry derivatives that define modern markets today. They have evolved from obscure securities traded by quants and academics into a hedging force so powerful that almost any major company uses them in some way. Derivatives are ubiquitous. They are essential to risk management.

Consider that most of the chaos has stemmed from derivative write-downs (mortgage-backed securities, collateralized debt obligations) and derivative-induced counterparty risk (credit default swaps).

Derivatives create the illusion of risklessness. Certain investors buy and sell derivatives to earn a profit, but most companies utilize them to reduce risk. The current crisis evolved when investors began to rely too heavily upon derivatives without assessing the true risk of the underlying assets. The complexity of derivatives obfuscated the true exposure of a security to the point where investors did not truly understand their risk profile. The perception of reduced risk was significantly exaggerated. Real risk was ignored.

Subprime loans - the key roots of this crisis - were inherently risky. Never before had such cheap credit been offered to borrows who were not creditworthy. So why did banks, thrifts, and other lenders offer them? Because they could package those mortgages up and sell them as derivatives. They thought they could sell away their risk.

In my opinion, a key takeaway from this chaotic episode is that risk cannot be sliced and diced. No matter how fancy our financial instruments get, reducing risk will never totally eradicate it.

0 Comments:

Post a Comment

<< Home